What consumer behavior reveals

about VR growth potential

The virtual reality market is in transition

Virtual reality as a consumer product sits in an uncomfortable spotlight. Recent signals point to a cooling VR market, with delayed headset launches and a growing view of VR as a specialized segment, while industry momentum increasingly shifts toward AI, AR, and connected eyewear.

However, location-based VR (LBE VR) is quietly demonstrating resilience and acceleration. According to PICO, Asia recorded triple-digit growth in LBE VR in 2025, with tens of thousands of headsets deployed across more than a thousand venues. Free-roam gaming operators like Zero Latency and Sandbox VR continue to scale internationally, while experiential studios such as Excurio, Félix & Paul, and UNIVRSE show that long-form, non-gaming VR can attract millions of paid visitors.

The signal is mixed, but not contradictory, as VR adoption is fragmenting by context, usage, and value proposition. To better understand what still resonates, and with whom, Habo explored how entertainment consumers in the United States and Western Europe engage with VR today, both at home and in an LBE context.

High consumer interest indicates growth potential for VR

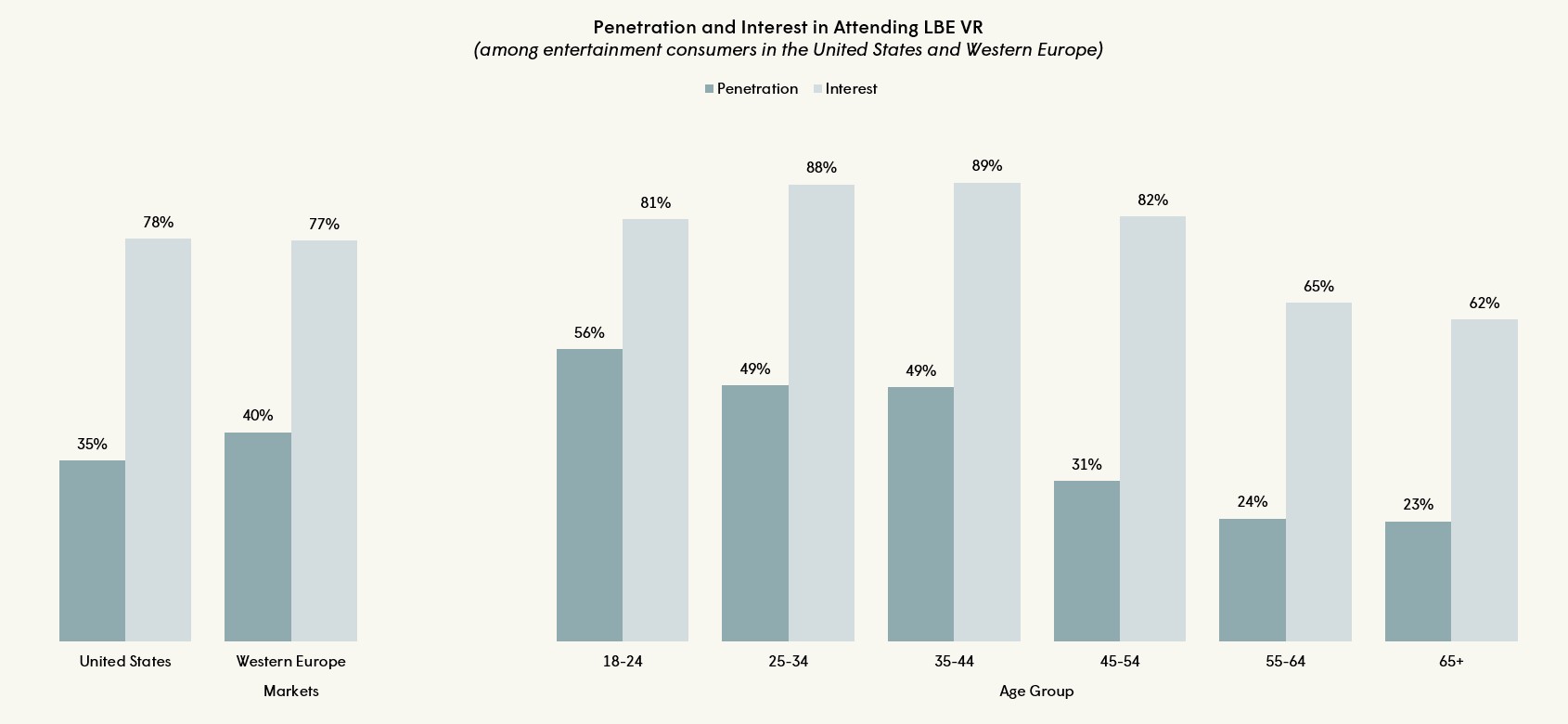

For LBE VR, all-time penetration is moderate with roughly one-third of entertainment consumers having tried it. Interest1 in these types of experiences is significantly higher, reaching above 75% among all entertainment consumers. This gap suggests less a lack of desire than a conversion challenge: supply, accessibility, and clarity of value still limit participation.

Age plays a defining role. Adults 18 to 44 are the most engaged overall, both in terms of participation and interest, while those 45 to 54 show high levels of interest despite much lower penetration. They possibly represent an underdeveloped opportunity.

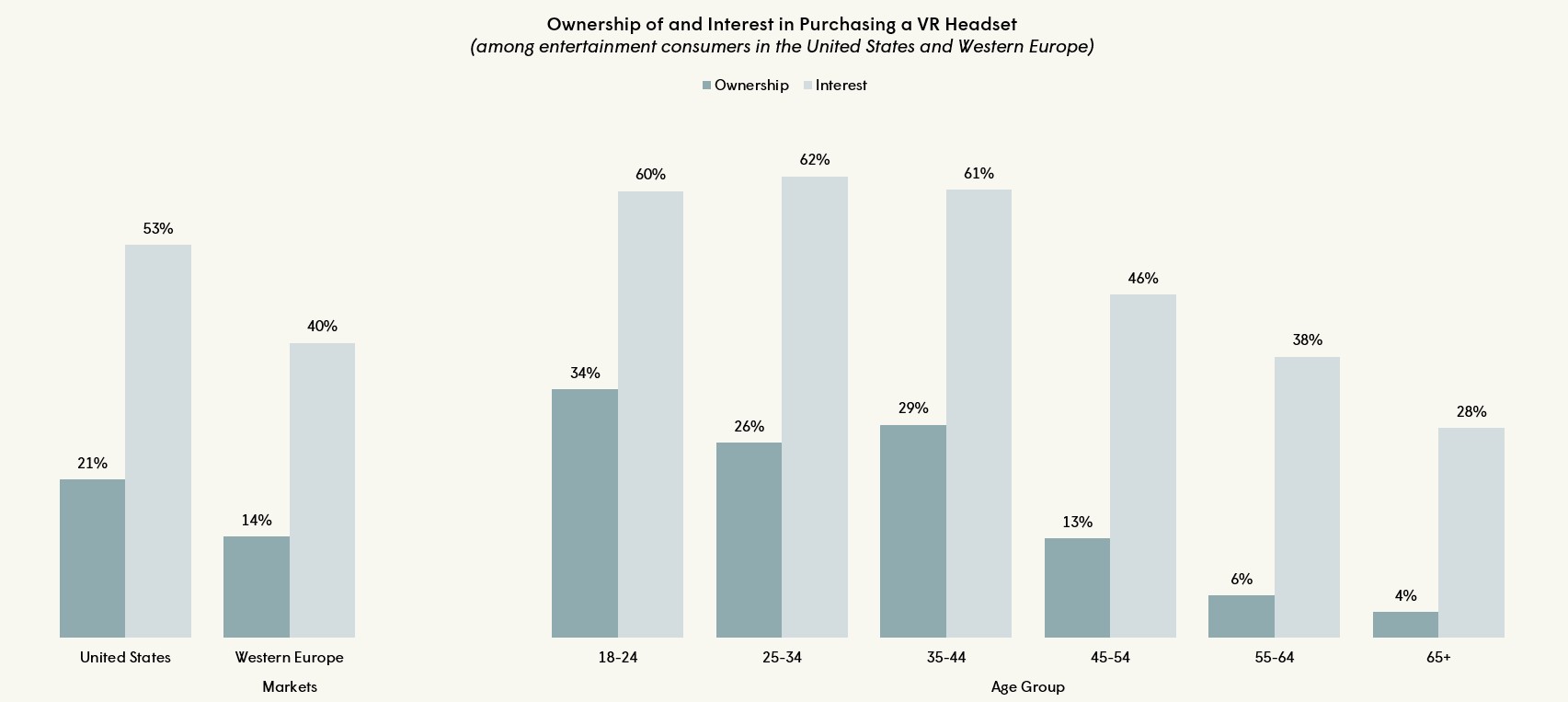

VR headset ownership rates are significant despite a higher commitment threshold. Among entertainment consumers, they exceed 20% in the US and remain lower but meaningful in Western Europe. Interest in future purchases significantly outpaces current ownership, especially among adults aged 18 to 44.

Ownership implies repeated use, suggesting that home VR, while more niche, can anchor deeper engagement.

VR is not broadly mainstream, but it is increasingly anchored among young adults and curious mid-life consumers. Strong interest in both LBE and home headsets suggests growth potential. Consumer motivations can provide key guidance for targeting and expansion.

VR resonates through immersion, social connection, and meaningful experiences

“I would be interested in participating in an immersive virtual reality experience because it allows me to fully immerse myself in another world, making the experience far more engaging and memorable than traditional media.”

“I’m interested in VR because it makes learning and exploring feel more real and exciting. It’s a fun way to experience new places or stories without leaving home.”

“It would be thrilling and otherworldly!”

“I think it allows me to dream and experience something that’s out of the ordinary in my life.”

Across markets, LBE VR succeeds when it feels special. Consumers consistently describe appeal through experiences that are new, immersive, interactive, and emotionally transporting. The language is less about technology and more about sensation: feeling like reality in a virtual environment, escaping to new and unique places, experiencing something different together. The social dimension appears repeatedly: VR as an activity to share with friends, children, or even grandchildren.

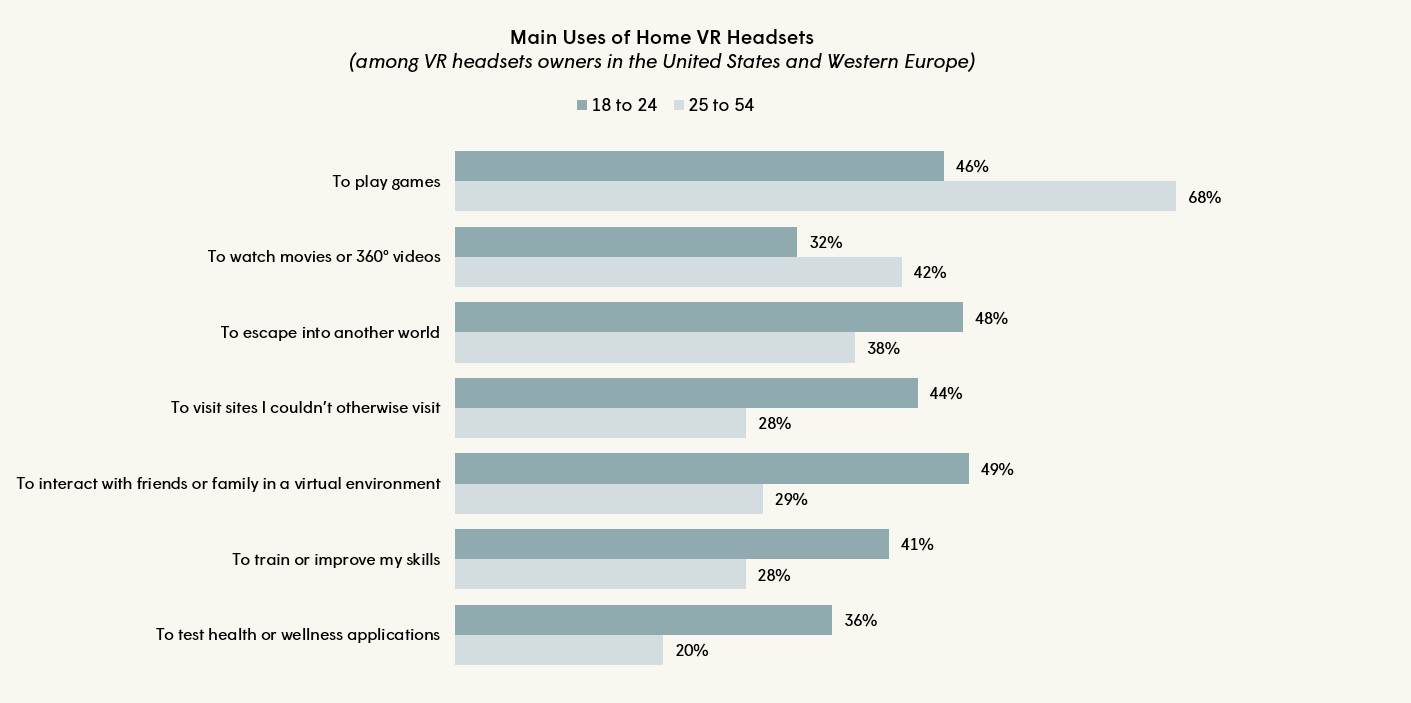

At home, VR usage varies by age and market.

— For 25 to 54, VR is primarily entertainment, dominated by gaming, with films and 360° video as secondary uses.

— Adults aged 18 to 24 treat VR as a broader experiential tool: social interaction in virtual spaces, escapism, skill development, wellness, and exploration all play a role. For this cohort, VR is not just play, it’s a parallel environment.

— Western Europeans tend to use VR more diversely than Americans, with higher engagement in health and wellness applications and virtual visits to cultural and tourist sites.

VR tends to resonate when it delivers emotional depth, social value, or meaningful escape.

Barriers stem from content, comfort, and accessibility perceptions

“Not seen anything that captures my attention or reflects my interests.“

“I am such a big fan of reality reality— I am not really interested in paying for virtual experiences.”

“I think it would be too far and expensive to find a place like that.“

“I’ve had a motion sickness experience before so now I’m turned off today the idea of the head sets entirely”

On the other end of the spectrum, many consumers still prioritize real-world, human experiences. VR is often perceived as isolating or as a substitute rather than a complement. Content perception is another friction point, as some describe VR as too childish, cartoonish, violent, or shallow. This signals less a rejection of VR itself than a mismatch between expected themes and personal interests.

Physical discomfort remains a persistent concern: motion sickness, eye strain, fatigue, and memories of early, underwhelming VR experiences shape expectations today. There are also some accessibility concerns: price expectations, urban concentration of venues, and the belief that VR “isn’t for my age.” These are not intrinsic limitations of the medium, but communication and design challenges that can be overcome.

Content will define what comes next

VR may not be on the verge of mass adoption, but it can grow and remain relevant among its foundational segments: committed gamers at home, families seeking shared outings, young adults exploring new forms of interaction, and a 45 to 54 audience waiting for the right proposition. LBE and home VR are not competitors; they reinforce each other. One thrives on the event and the collective moment, the other on frequency and personal immersion.

LBE VR, in particular, can learn from how 18 to 24 year olds use VR at home: for escapism, social presence, and identity exploration. Meanwhile, unmet interest among older adults points toward opportunities in narrative, cultural, and experiential content.

The common thread is that technology does not drive adoption, content does. For creators, the opportunity lies in designing experiences that speak directly to specific communities, emotions, and social contexts that already exist.

Habo will soon be releasing a second edition of this analysis, focused specifically on assessing the VR content value chain.

—