Monetizing Sports IPs Beyond Live Events - The F1 Case

Intellectual properties (IPs) are widely used in the entertainment industry to broaden audiences and deepen fan engagement, and sports IPs are no exception. Increasingly, sports IPs are being leveraged beyond live events to create new experiences that connect with existing fans and attract new ones across the globe.

To enrich the at-home fan experience, many sports IPs have expanded across multiple platforms—from acclaimed Netflix docuseries like Formula 1: Drive to Survive (2019) and Full Swing (2023), to blockbuster video game franchises such as NBA 2K and EA Sports NHL, and loyalty-driven fan platforms like the FC Barça app.

We’re also seeing significant growth in out-of-home entertainment, as sports IPs explore new mediums to reach untapped audiences.

Take Formula 1: once primarily a European sport, it has become a global phenomenon, connecting millions of fans through its races. Yet, based on Habo’s recent study, nearly 90% of F1 audiences in the U.S. and U.K. have never experienced a live race—most engage through TV or streaming. Reaching these audiences through other mediums presents a major opportunity.

Measuring the Potential of a Sports IP Across Entertainment Mediums

Although major sports IPs benefit from highly engaged fanbases, expanding into new entertainment formats does not guarantee success.

To assess the strength and potential of an IP across different mediums, Habo developed the Habo IP Index—a framework designed to measure the commercial value of existing brands and guide their optimization, diversification, and global expansion. The model evaluates three core dimensions:

- The IP’s overall health and performance indicators

- The depth of connection and intangible value from the fans’ perspective

- The IP’s potential for monetization and expansion across products and experiences

Habo IP Index: The Case of F1

As a case study, Habo conducted research with 3,000 adults across two key markets with differing levels of F1 maturity: the United States and the United Kingdom. The study tested 13 IPs, including the Formula 1 brand, the top four teams from the 2024 season, and their current drivers.

In light of the recent release of the F1 movie and the touring Formula 1 Exhibition, the findings offer valuable insight into how the brand can continue to grow its global reach and unlock new monetization opportunities.

Understanding F1’s Cultural Relevance in the U.K. and U.S.

To begin with, the U.S. and U.K. have distinctly different sports landscapes. In the U.K., Formula 1 is one of the most-followed sports—supported by decades of cultural relevance, local teams and drivers, and a deeply rooted fanbase. In contrast, the U.S. sports culture is more diverse, though largely dominated by domestic leagues such as the NFL, NBA, and MLB. The two markets also differ in how sports are consumed. In the U.S., sports are often intertwined with broader entertainment experiences—reflecting the country’s wider entertainment-driven consumption habits.

Despite these differences, the study highlights the strength of the F1 brand in both markets. Awareness is remarkably high—98% among the U.K. adult population and 88% in the U.S.—and the sport benefits from a strong reputation and increasingly engaged fans.

However, the cultural relevance and fans’ emotional connection to the sport and its IPs vary. In the U.K., F1 enjoys deep-rooted cultural significance, with fans forming lasting emotional bonds with specific teams and drivers. In contrast, while F1’s popularity is growing in the U.S., Americans are generally less familiar with individual drivers and teams—reflecting the sport’s more recent rise in visibility.

Leading Formula 1 IPs by Brand Value

While awareness is a promising indicator of commercial potential, the ability to extend an IP across different mediums also depends on the depth of fans’ attachment and their propensity to pay for various products and experiences based on that IP.

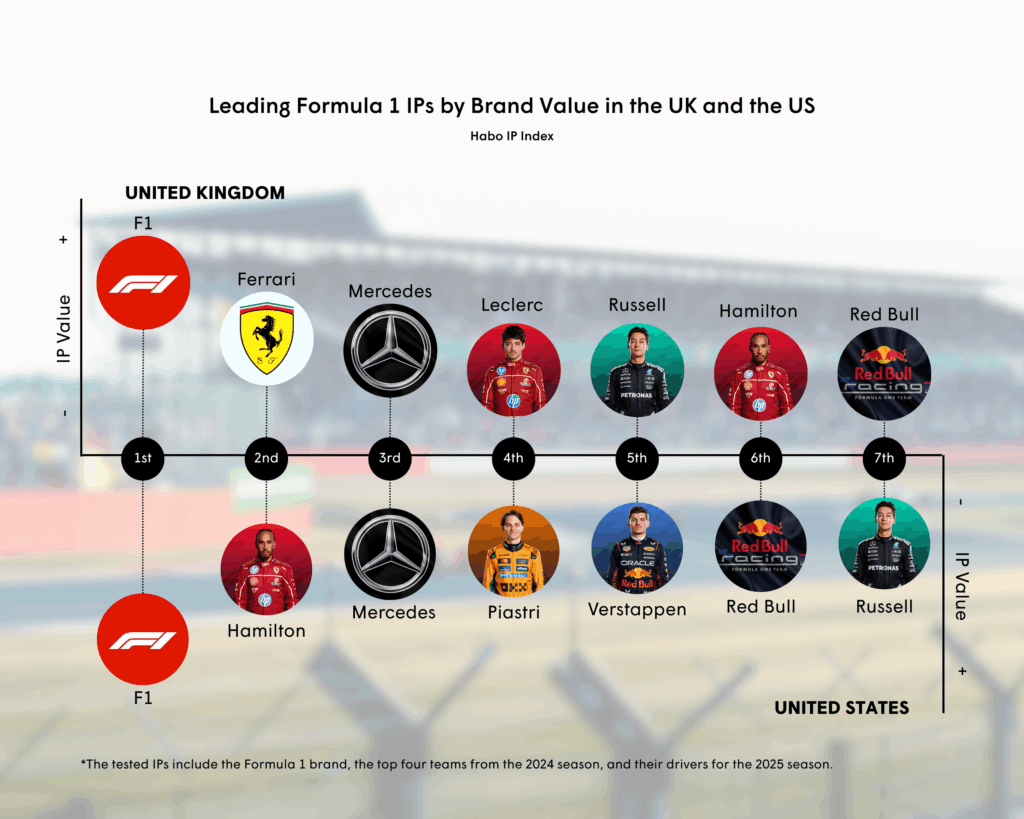

Based on the Habo IP Index, the study reveals the leading Formula 1 IPs by brand value:

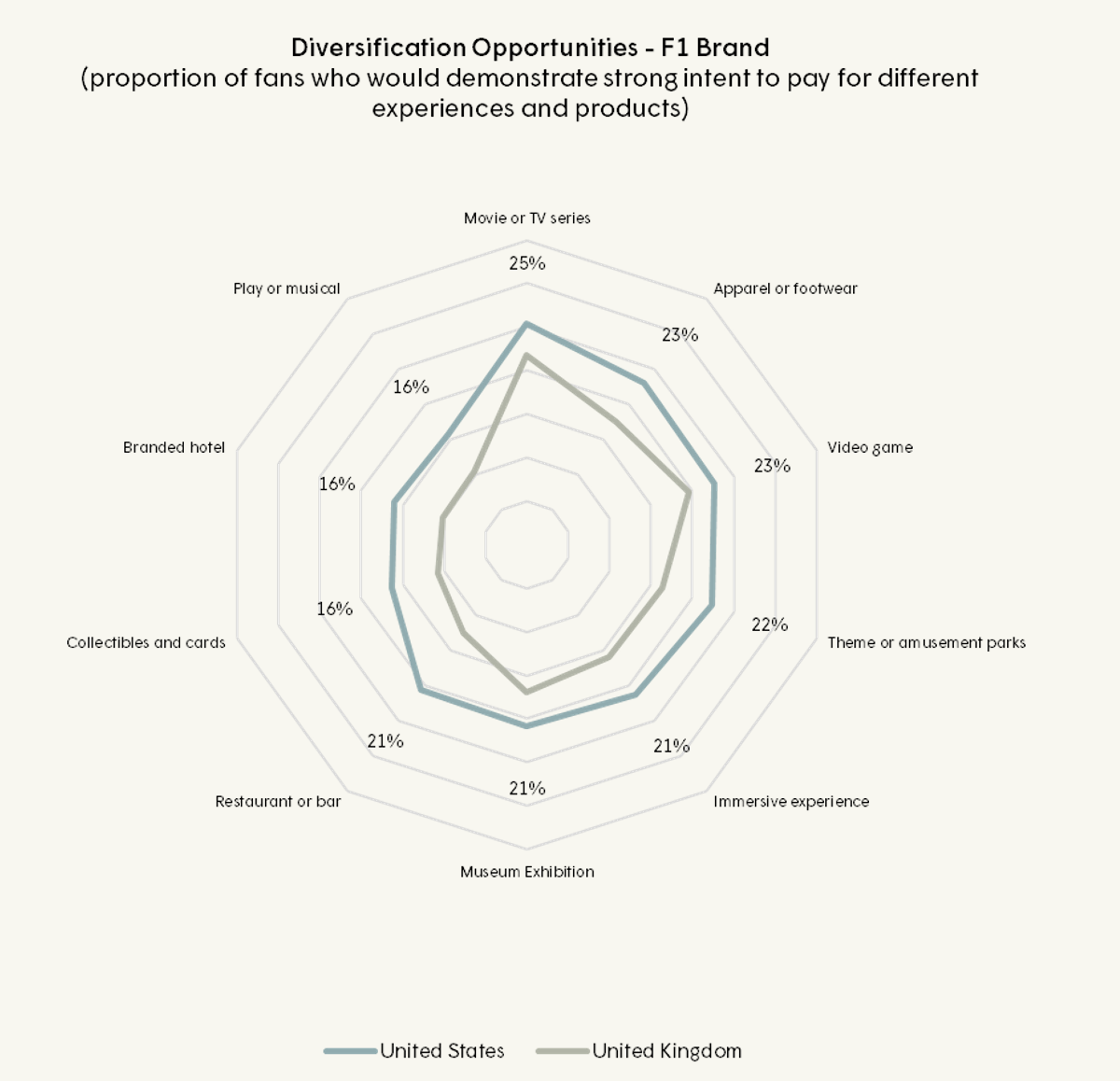

The F1 universe demonstrates strong opportunities for monetization across different products and experiences—generating particular interest in merchandising, video games, theme parks, and immersive experiences.

However, the ranking highlights key differences between the two markets.

In the U.K., the top-performing F1 IPs reflect its mature ecosystem—with three teams and several well-established drivers ranking at the top. In the U.S., a newer F1 market, top IPs are more diverse and more closely aligned with the current on-track performance of the sport.

What’s next?

To ensure the success of any sports IP-based experience, producers, creators, and IP owners must focus on IPs that are not only culturally relevant but also leverage their core pillars—why fans love them.

This study offers valuable insights into key market differences and the potential of sports-based experiences. Over the next few weeks, Habo will reveal key insights on how to successfully leverage these findings to unlock growth and engagement across diverse markets.

–

This study was conducted by Habo through the application of its proprietary methodology – the Habo IP Index – in partnership with Dynata, a provider of high-quality panels on a global scale. This collaboration allowed us to combine our approaches and ensure the accuracy and reliability of our findings.