Formula 1’s resonance across markets:

Insights from the Habo IP Index

Habo recently released an article examining the potential of sports intellectual properties (IPs) in entertainment, using Formula 1 as a case study.

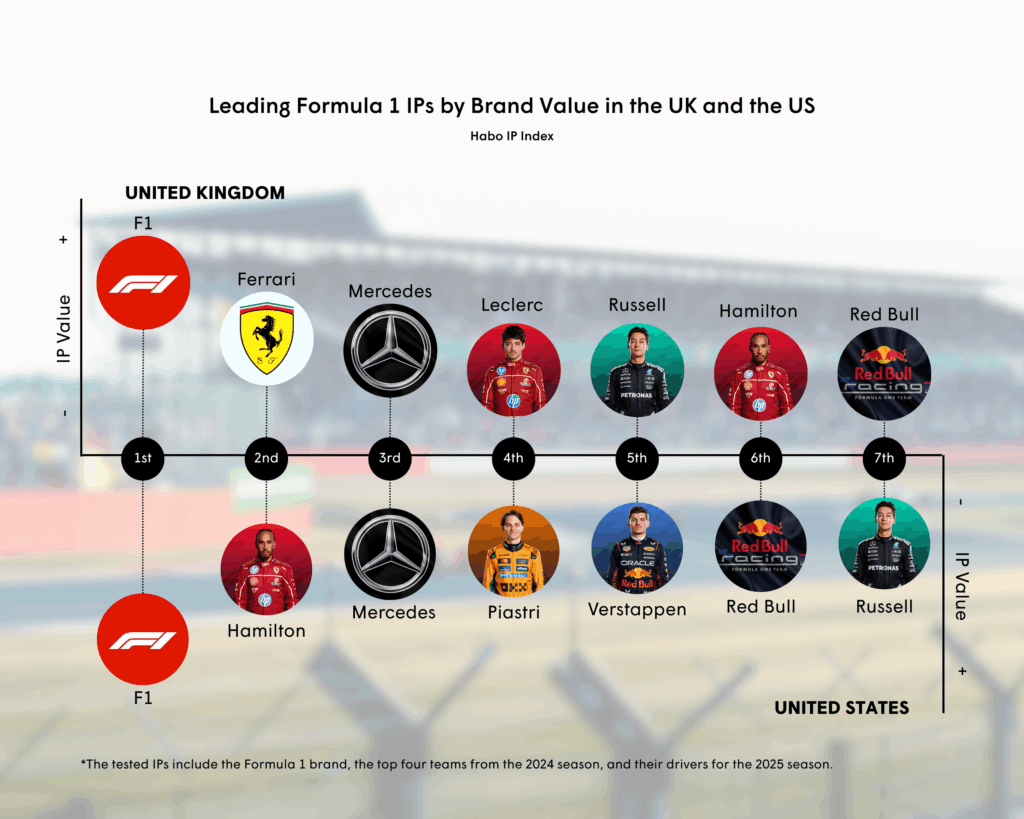

The study leveraged the Habo IP Index, a proprietary framework measuring the commercial value of brands for entertainment products and experiences, to assess the reach and monetization potential of top Formula 1 drivers and teams in two key markets: the United States and the United Kingdom.

By comparing these markets, each at a different stage of Formula 1 maturity, the study identified the top-performing Formula 1 IPs by brand value:

Building on these findings, Habo now explores how Formula 1 resonates across different cultural contexts, and how sports brands can tailor market-specific strategies based on the sport’s maturity.

1. Differing sports landscapes and cultural histories of Formula 1

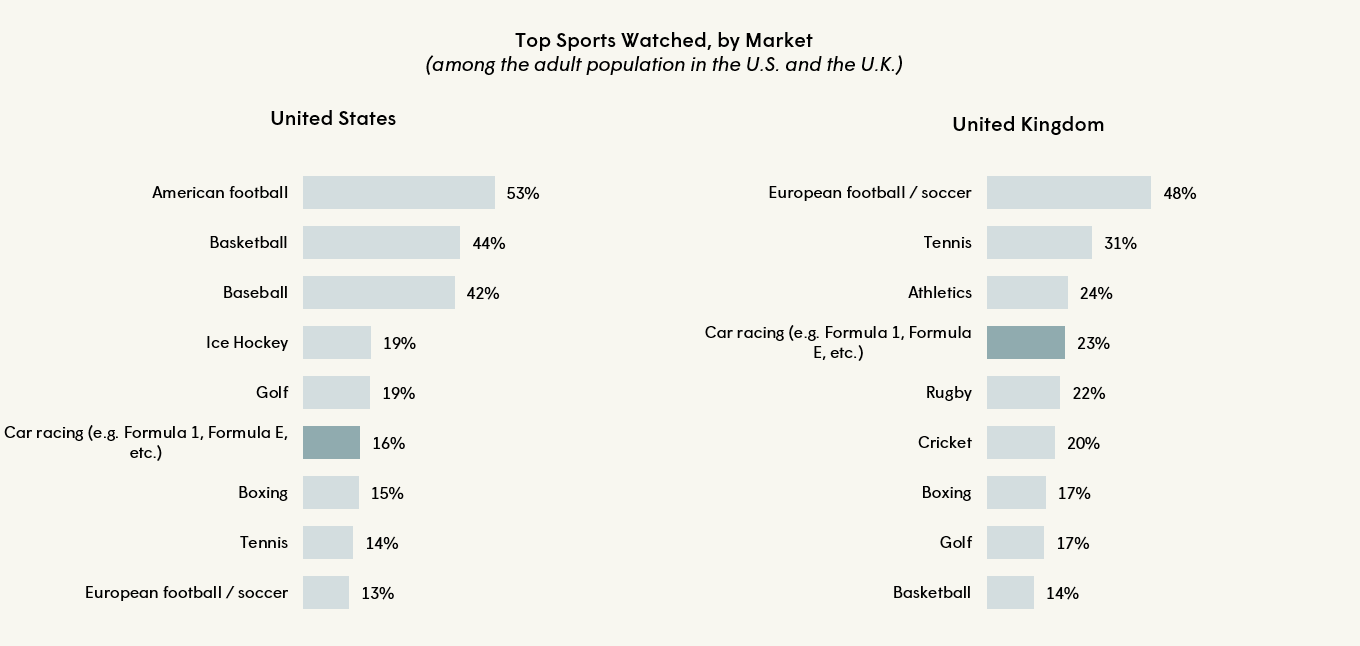

The first major difference between the U.K. and U.S. lies in the broader sports ecosystem and Formula 1’s historical presence.

Having originated and grown in Europe, Formula 1 is deeply embedded in U.K. sport culture, making it one of the sport’s most established markets with a broad, multigenerational fanbase. In fact, 42% of U.K. Formula 1 fans watch more than half of the races each season, demonstrating strong engagement.

In contrast, the United States presents a much more crowded sports market, dominated by well-established leagues such as the NFL, NBA, and MLB. Formula 1 has only recently gained traction here, thanks in part to the success of Netflix’s Drive to Survive and the addition of high-profile races in Miami and Las Vegas, a decade after the Austin Grand Prix’s establishment in 2012.

2. Varying levels of engagement

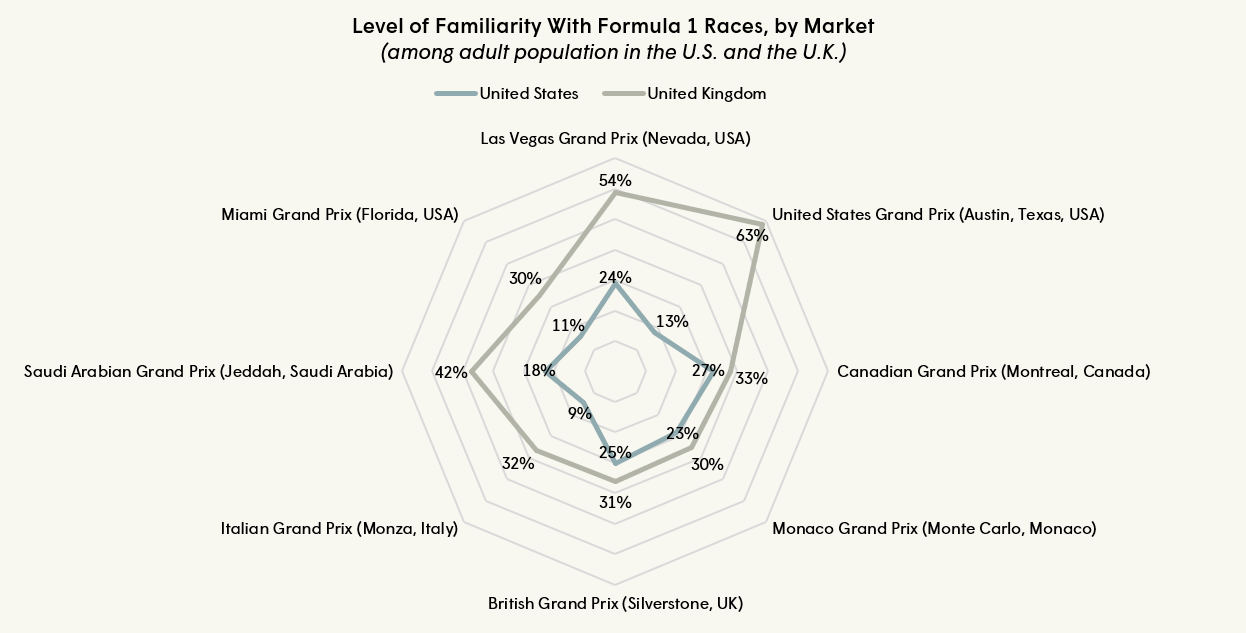

While the U.S. Formula 1 fanbase has grown significantly—reaching 69.2 million followers—most American viewers are primarily familiar with domestic races (Austin, Miami, and Las Vegas) and a few globally iconic events such as Monaco. Compared to the U.K., where the audience is more demographically diverse, U.S. Formula 1 viewers tend to skew younger and more male, primarily between 18 and 44 years old.

In contrast, Formula 1 fans in the U.K. exhibit a more sustained and deeply invested relationship with the sport. They are familiar with a broader range of international races, including Monaco, Monza, Jeddah and Austin, and are more likely to follow the sport consistently throughout the season. This highly engaged fanbase regularly consumes a variety of F1 content beyond the main races, including qualifying sessions, highlights, driver and team profiles, as well as pre- and post-race analysis.

3. Intangible pillars of the sport

Beyond history and market reach, the study highlights both shared and distinct drivers of fan passion in the U.K. and U.S.

In both markets, fans are drawn to core pillars of the sport: the thrill and adrenaline of high-speed racing, the skills of the drivers, the fierce competition and rivalries, the cutting-edge technology of the cars, and the strategic decisions of the teams. These shared brand pillars define Formula 1’s universal appeal.

However, how fans relate to these pillars varies.

Formula 1 in the U.K.: Rooted in tradition and heritage

In the U.K., Formula 1 is closely associated with tradition, legacy, and prestige. Fans often speak of growing up watching races with their families, rooting for historic teams, and the prestige surrounding classic circuits like Silverstone. The sport is perceived as elite, with fans forming lasting attachments not just to the competition itself, but also to specific teams and drivers.

— “I’m passionate about Formula 1 and have watched it since I was a little kid. I grew up watching Schumacher and Mika Häkkinen, and have been a huge fan of Lewis Hamilton since he started with McLaren in 2006/2007!”

— “I love it because I have loved cars and racing ever since I was a child, and I used to go to Silverstone with my dad. I was even taken around the track. It reminds me of my childhood and my dad, as he loved to watch the races.”

— “I have followed it ever since James Hunt and Niki Lauda. I love seeing the evolution of the sport, including safety, teams, drivers, circuits, and regulations. The rivalries between teams and drivers are riveting. I just love qualifying and the lights out!”

Formula 1 in the U.S.: Rooted in current performance and fan community

While the core reasons fans love Formula 1 remain similar, U.S. fans tend to focus more on current race performances rather than tradition. The entertainment value and vibrant global fan community are more important draws for American audiences compared to the U.K.

— “It’s exciting to watch all the amazing cars racing and to see the celebrities there.“

— “I think racing is really cool, and I enjoyed the F1 Drive to Survive series, which is what got me into the sport.”

— “It is exciting and fast-paced. You don’t need to know much about it because it’s easy to follow.”

— “What I love most are the cars and the fans, and connecting with others who enjoy this sport as much as I do.”

The case of Formula 1 demonstrates strong success in both geographic expansion and product extension that goes beyond traditional and established revenue streams, from immersive experiences to the sport’s own streaming platform.

Understanding how Formula 1’s cultural resonance and fan engagement differ significantly between the U.S. and U.K. enables sports brands to tailor their products and strategies effectively—capitalizing on tradition and heritage in established markets like the U.K., while emphasizing entertainment and community in growing markets such as the U.S.

–