Assessing the potential of European markets for new entertainment concepts

The European entertainment sector is experiencing significant growth, offering new opportunities for providers seeking to develop their offerings there.

Europe is a vast and diverse market, with dynamics that vary across regions. To support providers in the entertainment, sports, events and tourism sectors, Habo identified the most promising markets and highlighted their main characteristics.

How can we assess the most promising markets in Europe?

The metropolitan area as a unit of analysis for defining an entertainment market

In order to define the assessed entertainment markets, the study uses metropolitan areas as units of analysis due to their broader perspective, unlike the more restricted boundaries of a city. Studying these economically and socially integrated regions allows for a more accurate interpretation of the potential customer base (local and tourist), its movements, and competing offerings.

Key criteria for evaluating market attractiveness

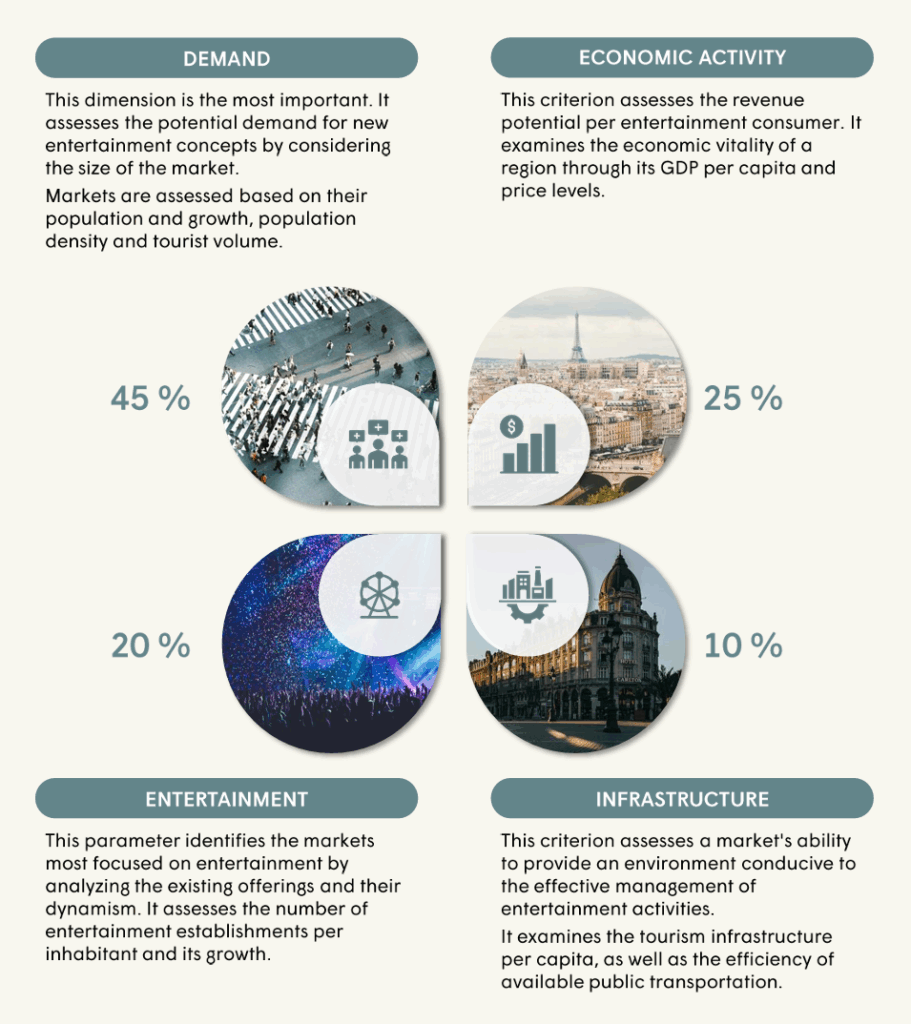

To identify the most promising markets for new entertainment concepts, Habo structured the analysis around four main dimensions:

Description and weighting of the four key criteria studied

Note: Habo applied the above weightings to each key criterion in order to quantitatively compare market potential. The weighting of each criterion was determined based on its importance to the commercial and creative success of a new entertainment project.

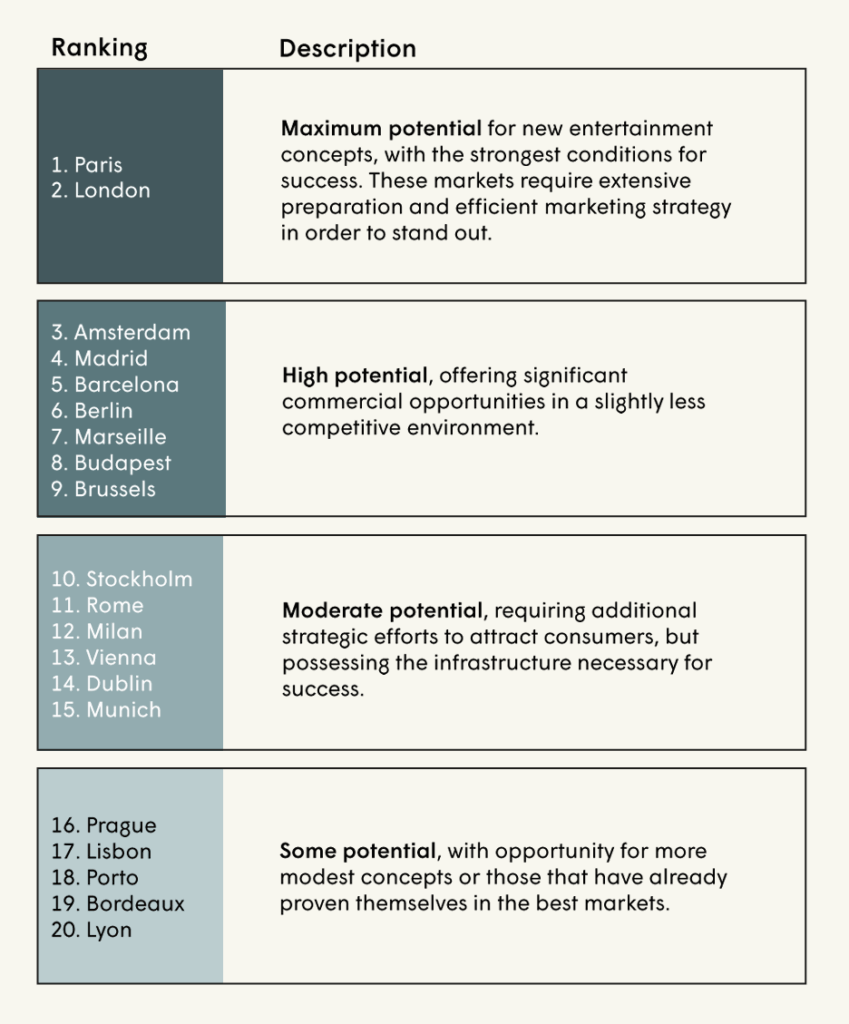

This evaluation enables the various European markets to be classified and categorised according to their potential for a new entertainment concept, taking into account the four dimensions of analysis.

Paris and London are positioned as the most promising markets in Europe for the rollout of a new entertainment concept, thanks to the size of their addressable market, the high willingness to pay of their residents, and the maturity of their entertainment ecosystem.

However, this attractiveness comes with intense competition: successfully establishing a presence in these markets requires a strong, differentiated concept that can establish itself in the long term, as well as an efficient and tailored marketing strategy.

Beyond the top tier, certain markets (high- and moderate- potential categories) offer strong promise while being less competitive than Paris or London, thus providing a better opportunity to establish a foothold. However, their limitation lies in the smaller size of the market or the still incomplete maturity of the entertainment ecosystem, which requires more effort to convince audiences to adopt a new concept. Madrid and Brussels are good examples of this dynamic: they have thriving cultural and recreational scenes, but are less saturated than the major capitals.

Finally, the lowest tier contains more secondary markets. They are more complex in terms of achieving large-scale success, but still offer some potential, provided that opportunities are carefully analysed and the strategy is adapted to the local context.

The success of an entertainment concept in a geographical market requires in-depth analysis and full adaptation to the local context.

This initial visualisation highlights the most promising European markets for a new entertainment concept. However, this is an exploratory analysis that needs to be further developed according to the specific characteristics of the project and its commercial and creative ambitions.

The next step is to assess the actual addressable market (particularly in terms of the target markets’ interest in the creative concept) and the competitive intensity of each region. Success will then depend on carefully adapting the local strategy in several areas:

— Concept and experience: By adjusting the creative concept to local preferences and socio-cultural codes.

— Price: By aligning the concept’s pricing with local sensibilities.

— Promotion: By adapting messages and channels to local media consumption habits.

— Location: By targeting locations with the highest potential in terms of footfall, accessibility and the surrounding environment.