Orlando vs. Las Vegas:

Key market trends of domestic visitors

Orlando and Las Vegas are widely recognized as top U.S. destinations in the entertainment and tourism sectors.

In a recent article, Habo explored the impact of each city’s distinct entertainment offerings on tourism. The article highlights how international tourism in these destinations is driven by their entertainment offerings, with Las Vegas known for its strong gambling and nightlife scene, and Orlando for its extensive range of theme and attraction parks.

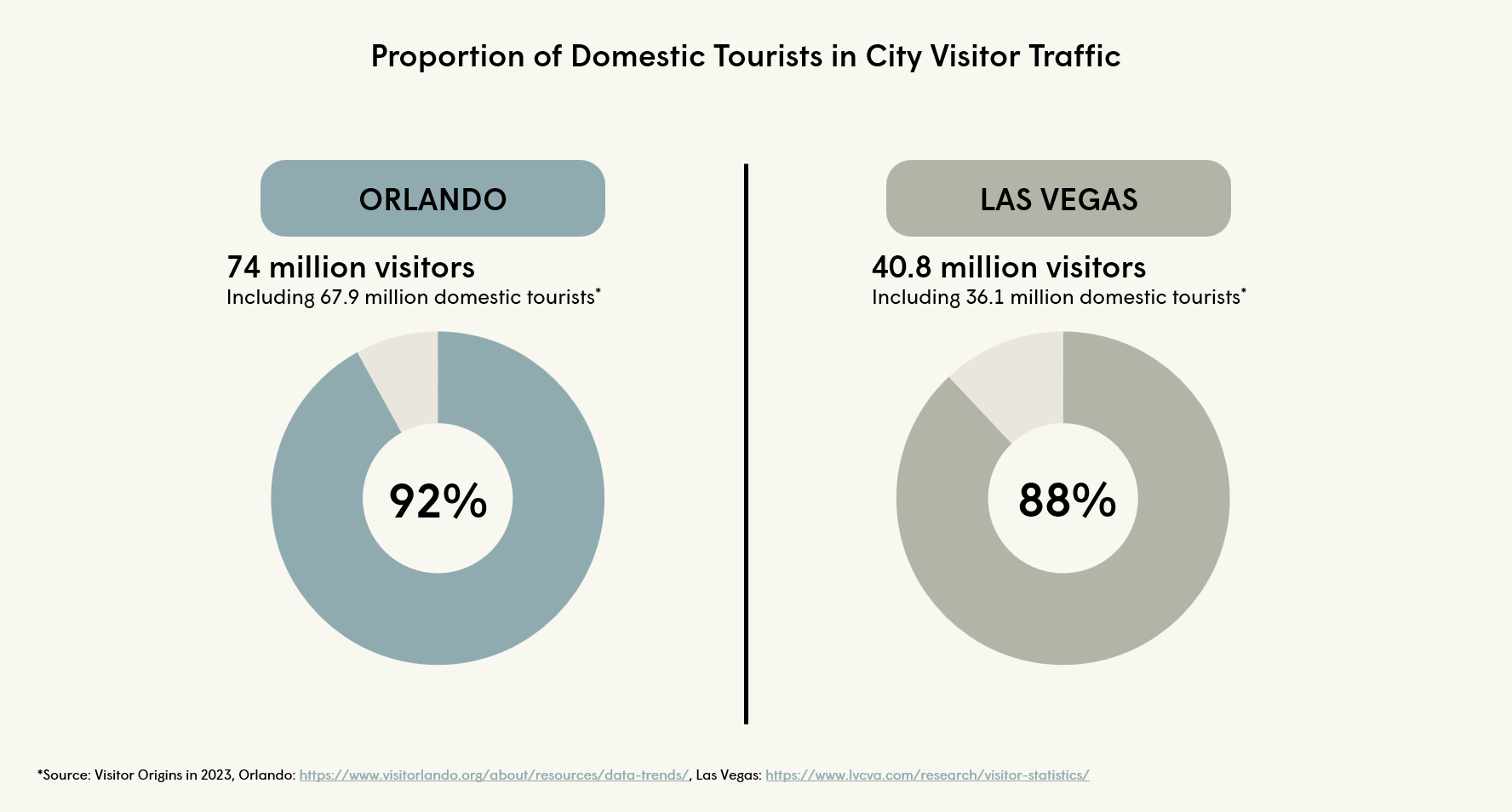

Beyond these cities’ appeal to international visitors, both also rank among the most popular U.S. destinations among Americans.

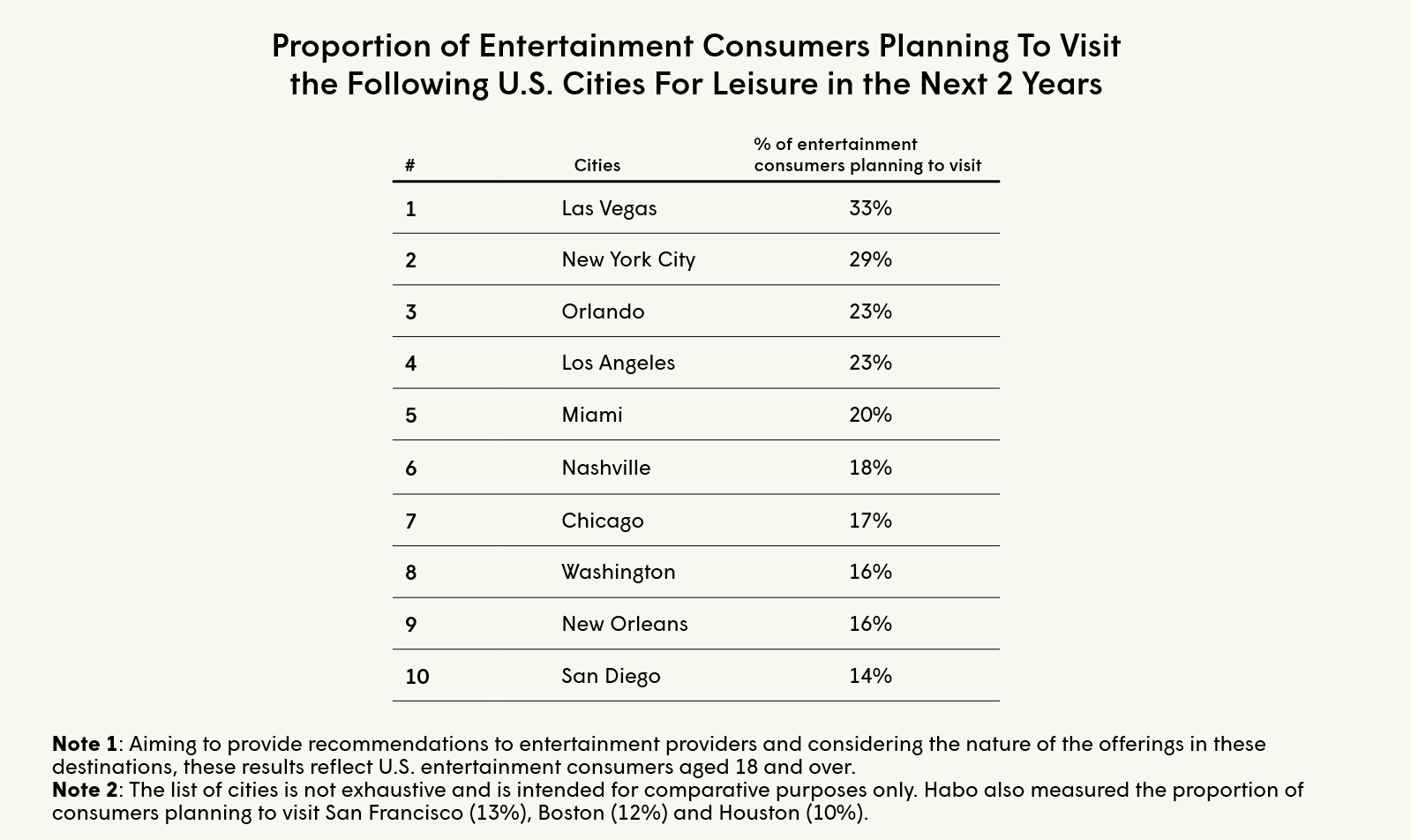

According to a recent study conducted by Habo among U.S. entertainment consumers1, 33% intend to visit Las Vegas and 23% Orlando within the next two years. Although Orlando’s appeal appears to be lower, the annual number of American visitors to Orlando is nearly twice that of Las Vegas, largely due to the fact that many travel parties visit Orlando with children.

Nevertheless, for both destinations the vast majority of visitors are domestic tourists, which underscores the importance of understanding the key dynamics regarding American visitors in order to effectively position offerings in these markets. This article examines three key domestic tourism trends and how they can be leveraged by entertainment providers in their marketing strategy.

1. Beyond their entertainment offerings, proximity also plays a key role in the appeal of Orlando and Las Vegas for domestic tourists.

Consistent with Habo’s findings from its previous study, entertainment attractions in Orlando and Las Vegas are the main driver of visits among domestic tourists, and have shaped the cities’ reputation and popularity.

However, when choosing a U.S. travel destination, American tourists also consider proximity as an important factor. Consequently, Las Vegas tends to attract more visitors from the Western U.S. (59%), with California as the primary state of origin (36%), while Orlando draws more visitors from the Southern region, with most domestic tourists coming from Florida (41%), as well as Georgia, Texas, and other northeastern states like New York.

For entertainment providers aiming to enter these markets, this presents a strategic opportunity to target audiences based on geographic location to optimize marketing efforts.

2. With Orlando and Las Vegas attracting distinct audiences, entertainment providers must ensure their offerings align with the preferences and behaviors of these destinations’ target segments.

Similar to what is observed with international tourists, these destinations’ focus on entertainment also shapes the demographics of domestic visitors. For instance, Las Vegas’s positioning around gambling and nightlife influences the composition of its audience, primarily attracting men (57%). Visitors also tend to come either as couples (51%) or in groups of friends (34%). In contrast, Orlando appeals to a more diverse range of consumers, spanning a broader range of ages and group compositions, with a particular attraction for families, whether with children (38%) or other family members (35%).

As the entertainment landscape has evolved to better serve these key audiences, Orlando has expanded its offerings to include mass audience attractions like zoos and aquariums, while Las Vegas has developed complementary offerings such as live performances and immersive experiences.

With this in mind, entertainment providers should ensure a strong product-market fit with destinations’ positioning, offering experiences that attract key audiences to these cities in order to sustain long-term demand.

3. Since both Orlando and Las Vegas are highly competitive entertainment markets, providers must engage with travelers early on in their customer journey.

In addition to geographic and sociodemographic factors, effectively targeting key audiences also requires engaging at the right moment in the consumer’s decision-making process. Studies conducted by Habo reveal that domestic tourists often plan certain activities in advance when visiting entertainment-focused destinations like Orlando and Las Vegas.

For instance, when planning their trip to Las Vegas, most U.S. travelers purchase tickets for at least some activities ahead of time. The majority of those who don’t at least identify a few experiences they want to participate in before their trip. This dynamic makes the search process key in their decision-making , and entertainment providers should position their experiences to ensure they are top-of-mind for visitors.

This pattern also shows the importance of engaging with audiences early—before their trip even begins—to capture a share of their spending, with the best strategies and most sought-after sources for domestic tourists being search engine optimization, social media, tourism and destination websites, as well as user reviews.

To succeed in major hubs like Orlando and Las Vegas, entertainment providers must understand their target audiences and the key dynamics that shape domestic tourists’ demand. While both markets offer significant opportunities, providers should tailor their strategic approach to visitors’ preferences and behaviors.

Key strategies for navigating entertainment-driven markets like Orlando and Las Vegas:

- Tailor the targeting strategy based on audiences’ geographic location and sociodemographic characteristics.

- Ensure strong product-market fit with both the target audience and the destination positioning.

- Strategically position the experience early in visitors’ search and decision-making process for activities at the destination.

1 According to Habo’s methodology, entertainment consumers are adults aged 18 and over who participated in at least one paid out-of-home entertainment activity in the past year.